can you work part time on disability ontario

The SSA defines Substantial Gainful Activity SGA as any monthly earnings over 1260 except for those who receive disability for vision problems. Ad Social Security Disability Insurance Stops If You Earn More Than Certain Monthly Limits.

A Snapshot Financial Institutions Workplace Research Resources Knoll Financial Institutions Bring Your Own Device Byod

There are 2 principles at play when determining job security if an employees short-term disability places a hindrance to employment.

. However the new work must be different than the one you got injured doing. But if your regular work before applying for disability was part-time work and Social Security finds you can still do this work your claim will be denied. Deutschmann Law assists Personal Injury victims in the greater Kitchener Waterloo area.

You can work part time while you apply for Social Security disability benefits as long as your earnings dont exceed a certain amount set by Social Security each year. Depending on the circumstances working part-time while on disability may affect your. The SGA amount is a set maximum monthly wage that helps the Social Security Administration SSA determine whether or not your disability prevents.

Yes you can work while receiving Social Security Disability Insurance SSDI benefits but only within strict limits. This allows them to return to part-time work while continuing to receive ongoing benefits. The reality of Social Security disability benefits is that the monthly amounts are low.

At Disability Advocates Group our practice is dedicated to protecting the rights of disabled individuals throughout Southern California. For Ontario disability recipients you are living on the edge every day. While youre getting Canada Pension Plan CPP disability benefits you may be able to.

Earnings between 20 and 80 of your prior income will usually reduce your full LTD amount in. Payments will stop if you are engaged in what Social Security calls substantial gainful activity. LTD benefits can top up where income earned is low.

The SGA for 2018 is set at. Your eligibility for ODSP depends on medical and financial circumstances. Up to 25 cash back Many policies provide for residual or partial disability payments which allow someone capable of only part-time work to receive ongoing benefits.

If youre working part-time and are earning more than the maximum amount per month set by the SSA then your eligibility for SS disability benefits could be in jeopardy. While Murphy can count on receiving ODSP benefits during the COVID-19 pandemic it is the income he derives from a part-time job that he depends on to make ends. The maximum benefit period is the maximum number of weeks you can get payments.

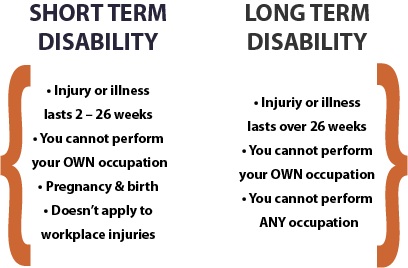

Tell ODSP about any. In 2022 the average monthly benefit for a disabled individual is 1358. Short-term disability benefits cover a short leave from work.

Find out what information we look at when deciding your eligibility and how much you can earn and keep in assets while being on ODSP. Insurance policies can appear to be complex and difficult to understand. Though the benefit amount can be higher most people dont receive the maximum amount.

If youre on disability under an own occupation own occ policy you can perform part-time or sometimes full-time work. Long-term disability benefits and work - working parttime will reduce income benefits. As long as you.

Going back to work. In the majority of states employers arent required to offer it but employers. If earnings are 60 to 70 of pre-disability income.

Short-term disability insurance provides compensation to employees unable to work because of an illness or injury expected to last at least seven days. Learn how these affect your income support and eligibility on ODSP. The short answer is yes.

Go back to school. These LTD policies are generally more flexible in allowing policy holders to work than any occupation policies. Depending on how much is earned your LTD benefits could be reduced to zero.

Sick leave is the only statutory leave that is provided for by the Employment Standards Act for stress. The rules of the Ontario Disability Support Program ODSP say that you can work and still get. Youre living with worry every day says Bob Murphy who receives benefits from the Ontario Disability Services program ODSP.

You can work part time while on Social Security Disability. They use the money they get to support people with disabilities who. You can earn a certain amount of money without losing your disability benefits.

Thats 16296 annually about 2700 over the federal poverty line. 1180 per month for non-blind applicants. The courts decision that an employer is not discriminating against an accommodated employee who can only work part time because of a disability when it fails to provide the employee the benefits that a full-time employee receives is equally relevant to employers whose employees are not unionized.

Take a re-training program arranged by CPP. SGA as its known is defined in 2022 as earning more than 1350 a month or 2260 if you are blind. In this case you can continue working part-time on disability while collecting full benefits as long as your earnings are not considered by the SSA to be substantial.

An employer will be able to justify ending employment if they demonstrate that employment has become. Income between 20 and 80 of your pre-disability income will usually reduce your LTD benefit in proportion to their earnings. You dont qualify for benefits if you can work in a different job from the one you had before your disability based on your training experience and education.

Employers may offer various benefits as part of your group benefits package including short-term and long-term disability benefits. Are You Taking Part in One of Social Securitys Work Incentives Programs. If you are seeking disability benefits you may be wondering whether you can receive benefits while working part-time.

The ODC concluded that the employees different treatment was based on a different level of work and not their disability and was therefore acceptable under the OHRC. You might reach the end of the benefit period and still not be able to work. The amount of time varies between plans but its generally between 17-52 weeks.

When you fall ill or sustain an injury that leaves you unable to work for a period of time applying for disability benefits can seem overwhelming and like a monumental task. It also helps people with disabilities start their own business. Well update this information as things change.

Rules Regarding Working While on Short Term Disability. The Opportunities Fund for Persons with Disabilities program helps people with disabilities prepare for get and keep jobs. When considering a claim for disability one of the first determinations Social Security must make is whether you can do your past relevant work that is jobs youve done in the past.

You just have to make sure your income doesnt exceed the limitations for substantial gainful activity or SGA. The 2 principles at play are the concept of frustration and the employers duty to accommodate. If you earn more than this amount called the substantial gainful activity SGA limit Social Security assumes you can do a substantial amount of work and you wont be eligible for disability.

Most Any Occupation policies provide partial disability payments to someone capable of only part-time work. In Ontario employees used to be entitled to ten days of something called personal emergency leave but that was eliminated in 2019. Thus employees suffering from stress can only take sick leave.

Regular or own occupation The definition of regular or own occupation plan means youll receive benefits if youre unable to perform the main duties of the job you had at the time the disability started. Unlike Social Security Disability Insurance this isnt a federal benefit. Businesses municipal governments and organizations may apply for the Opportunities Fund.

The ODC clarified that employers do not owe a part-time worker full time benefits even if the reason for their part-time employment was an accommodation for a disability. Sick leave is only for a maximum. You must tell CPP if you go back to work full time or earn more than 10 of the years pensionable.

That are between 9 and 16 months in the future.

Can You Be Fired While On Long Term Disability Dutton Law

Short Term Disability Ontario Know Your Rights Monkhouse Law

Long Term Disability Ontario Know Your Rights Monkhouse Law

Long Term Disability The Ultimate Guide 2021 Resolute Legal Disability Lawyers

Can You Be Fired While On Short Term Disability In Ontario Monkhouse Law

Lets Talk About Learning Disabilities Conference Brochure 2013 Page 1 Learning Disabilities Technology Solutions School System

The Difference Between Short Long Term Disability Insurance

Short Term Disability Ultimate Guide 2021 Resolute Legal Disability Lawyers

Disability Support Undergoing Change In Ontario Employed People Receiving Disability Keep More But Qualifying Is More Difficult Pivotal Integrated Hr Solutions

Injured In An Accident Disabled As A Result Of An Injury Serving Multiple Locations In Ontario Kalsi Associates Per Personal Injury Lawyer Personal Injury Slip Fall

A Closer Look At Short Term Disability Benefits In Ontario

Long Term Disability In Ontario Simple Guide Dutton Employment Law

Pin On Disability Accessibility

Disability Support Undergoing Change In Ontario Employed People Receiving Disability Keep More But Qualifying Is More Difficult Pivotal Integrated Hr Solutions